If you want to invest in growth marketing then there are some reasons to start investing in mutual funds now.A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt.

The second option to invest in Stock Market is that your buy individual stocks but is time consuming which needs lots of reasearch and expertise. Maybe you feel lack of these expertise, then you buy should a portfolio of stocks instead of buying a single stock. You can easily buy Portfolios by investing in mutual funds.

Benefits of Mutual Funds

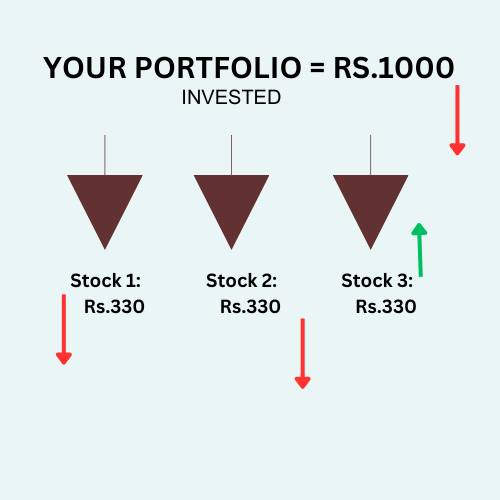

1. MANAGE YOUR RISKS

You can easily reduce your risk by investing in Mutual Fund. Putting whole money at a single stock leads you to bear a great risk. If you have put money in one of the bank stocks and if that doesn’t work then your entire investment will reduce in that stock. But if you have put it in three banks and one of the investment does not work and rest are doing all right then suddenly you can manage all that risk within that sector.

2. RISK ACROSS INDUSTRIES

If you put money in bank and banking industry is itself is weak, but at the same time you also put your money in pharma and the pharma industry is growing currently then you are balanced. Mutual funds provides you the great platform to invest in different companies that distributes your risk. In Covid era hospitality industry was suffering a lot and at the same time E-commerce or the Technology industry is growing. If invest in different sectors then it will spread your risk.

What is an investment fund? Double your money easily.

3. EXPERTISE

What if

Which Mutual Fund to pick?

There are lots of mutual funds to invest but the right appraoch is to go after Index Mutual Funds. Most of the new investors invests in NIFTY 50’s Index mutual fund.Nifty 50 is a benchmark that represents the weighted average of 50 of the largest Indian Companies by market capitalisation listed on the National Stock Exchange.

Nifty 50 Companies List February 2024

The following table lists the Nifty 50 companies:

| Company Name | Sector | Weightage |

| Adani Enterprises Ltd. | Metals & Minerals Trading | 0.84% |

| Adani Ports & Special Economic Zone | Transport Infrastructure | 0.69% |

| Apollo Hospitals Enterprise Ltd. | Healthcare Services | 0.57% |

| Asian Paints Limited | Consumer Durables | 1.77% |

| Axis Bank Ltd. | Banks | 3.13% |

| Bajaj Auto Limited | Automobiles | 0.64% |

| Bajaj Finserv Ltd. | Finance | 0.97% |

| Bajaj Finance Ltd. | Finance | 2.29% |

| Bharti Airtel Ltd. | Telecom – Services | 2.56% |

| Bharat Petroleum Corporation Ltd. | Petroleum Products | 0.43% |

| Britannia Industries Ltd. | Food Products | 0.68% |

| Cipla Ltd. | Pharmaceuticals & Biotechnology | 0.62% |

| Coal India Ltd. | Consumable Fuels | 0.62% |

| Divis Laboratories Ltd. | Pharmaceuticals & Biotechnology | 0.54% |

| Dr Reddys Laboratories Ltd. | Pharmaceuticals & Biotechnology | 0.67% |

| Eicher Motors Ltd. | Automobiles | 0.62% |

| Grasim Industries Ltd. | Cement & Cement Products | 0.78% |

| HCL Technologies Ltd. | IT – Software | 1.49% |

| HDFC Bank Ltd | Banks | 13.77% |

| HDFC Life Insurance Company Limited | Insurance | 0.72% |

| Hero MotoCorp Ltd. | Automobiles | 0.44% |

| Hindalco Industries Ltd. | Non – Ferrous Metals | 0.73% |

| Hindustan Unilever Ltd. | Diversified FMCG | 2.93% |

| ICICI Bank Ltd. | Banks | 7.87% |

| Indusind Bank Ltd. | Banks | 1.03% |

| Infosys Limited | IT – Software | 6.01% |

| ITC Ltd. | Diversified FMCG | 4.55% |

| JSW Steel Ltd. | Ferrous Metals | 0.81% |

| Kotak Mahindra Bank Limited | Banks | 3.04% |

| Larsen and Toubro Ltd. | Construction | 3.84% |

| LTIMindtree Limited | IT – Software | 1.23% |

| Mahindra & Mahindra Ltd. | Automobiles | 1.45% |

| Maruti Suzuki India Limited | Automobiles | 1.53% |

| Nestle India Ltd. | Food Products | 0.95% |

| NTPC Limited | Power | 1.02% |

| Oil & Natural Gas Corporation Ltd. | Oil | 0.74% |

| Power Grid Corporation of India Ltd. | Power | 0.98% |

| Reliance Industries Ltd. | Petroleum Products | 9.56% |

| SBI Life Insurance Company Ltd. | Insurance | 0.68% |

| State Bank of India | Banks | 2.77% |

| Sun Pharmaceutical Industries Ltd. | Pharmaceuticals & Biotechnology | 1.30% |

| Tata Consultancy Services Ltd. | IT – Software | 4.04% |

| Tata Consumer Products Limited | Agricultural Food & Other Products | 0.58% |

| Tata Motors Ltd. | Automobiles | 1.14% |

| Tata Steel Ltd. | Ferrous Metals | 1.05% |

| Tech Mahindra Ltd. | IT – Software | 0.86% |

| Titan Company Ltd. | Consumer Durables | 1.45% |

| UltraTech Cement Limited | Cement & Cement Products | 1.12% |

| UPL Ltd. | Fertilizers & Agrochemicals | 0.44% |

| Wipro Ltd. | IT – Software | 0.74% |

What are the benefits of investing in the Nifty 50 Index?

- Good returns in the long run: Nifty 50 was launched in 1996 with a base value of 1000. It reached the 15000 mark in 2021. Hence investing in index-based funds will provide good returns in the long run.

- No bias by the fund manager: The index fund’s portfolio depends on the index directly, and the fund manager doesn’t have control over it. Hence it is free from fund manager bias.

- Lower expense ratio: Index funds have a lower expense ratio when compared to other types of mutual funds. Since they are passive funds, the fund manager’s role is minimal, and hence the fund management fees are also low.

- Market returns: The index funds offer market returns as they are a replica of the index. Their performance is directly dependent on the movement of the index. Hence it is easier to track investments.